Best Prepaid Debit Cards of 2024

- 1 2024’s Best Prepaid Debit Cards

- 2 Bluebird by American Express

- 3 American Express Serve FREE Reloads

- 4 Walmart MoneyCard

- 5 American Express Serve Cash Back

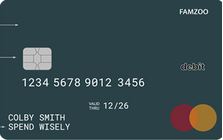

- 6 FamZoo Prepaid Debit Card

- 7 FAQs Q: What Is the Best Prepaid Debit Card?

- 8 Q: What Are the Downsides of Prepaid Debit Cards?

- 9 Q: What Is the Best Prepaid Card With No Fees?

- 10 Q: What’s the Best Prepaid Card for Direct Deposit?

Prepaid debit cards are becoming a common and practical tool for many people when it comes to managing their money. The finest prepaid debit cards provide security and flexibility for managing money without a typical bank account, controlling spending, or establishing credit.

Selecting the best option can be difficult given the abundance of options. This article will examine the best prepaid debit cards available, highlighting features and low costs to help you make an informed choice that fits your budget and way of life.

2024’s Best Prepaid Debit Cards

| Card | Monthly Fee | No-Fee ATMs | Rewards | 1%-3% cash back with an annual cap |

|---|---|---|---|---|

| Bluebird by American Express | No | Yes, 30,000+ | No | Free at Family Dollar; potential fee elsewhere |

| American Express Serve FREE Reloads | $6.95 in most states | Yes, 30,000+ | No | Free at Walmart, 7-Eleven, CVS, Rite Aid, Dollar General, Family Dollar |

| Walmart MoneyCard | $5.94 unless you load $500 or more per month | No, $2.50 per withdrawal | 1%-3% cash back with annual cap | Free via the Walmart MoneyCard app, direct deposit, mobile deposit, bank transfer |

| American Express Serve Cash Back | $7.95 in most states | Yes, 30,000+ | 1% cash back with no limit | Fees up to $3.95 |

| FamZoo | $5.99, or less with advance payment | Yes | No | $4.95 at participating retailers |

We’ve covered more information on these prepaid debit cards, along with their benefits and drawbacks, below.

Bluebird by American Express

If you’re looking for a convenient and cost-effective prepaid debit card, American Express Bluebird is an excellent option. You can use a lot of free ATMs and not worry about monthly costs when you use Bluebird.

Additionally, they provide some free extra benefits, enhancing the security of your card purchases and presenting you with some fantastic deals. Bluebird has lower costs than other prepaid debit cards, which is great if you’re on a tight budget or simply don’t want to pay more to use a debit card.

You may also create individual accounts for each member of your family, and everyone will receive a card linked to the main account. This is a really cool feature.

Pros:

- No fee when you load cash onto your card at more than 45,000 Walmart, 7-Eleven, CVS, Rite Aid, Dollar General, and Family Dollar locations

- Other reload options include direct deposit and bank account transfers

- Access to more than 30,000 fee-free ATMs

- Eligible purchases get purchase protection*

Cons:

- There’s a $6.95 monthly fee (no fee in New York, Texas, or Vermont)

- Mobile check deposits take 10 days unless you pay a fee

- No rewards or other major be

American Express Serve FREE Reloads

For those who use prepaid debit cards frequently and need to reload, American Express Serve FREE Reloads is ideal. There are numerous areas where users can add money without incurring any fees. Furthermore, the availability of fee-free ATMs is consistent with the card’s free reloads.

Cash reloads become a practical solution for people without checking accounts, which is why Amex Serve FREE Reloads are the recommended option. Family members can also open free sub-accounts with this card.

Pros:

- No fee when you load cash at over 45,000 locations, including Walmart, 7-Eleven, CVS, Rite Aid, Dollar General, and Family Dollar

- Various reload options, including direct deposit and bank account transfers

- Access to over 30,000 fee-free ATMs

- Eligible purchases receive purchase protection*

Cons:

- $6.95 monthly fee (except in New York, Texas, or Vermont)

- Mobile check deposits take 10 days unless a fee is paid

- No rewards or significant benefits

Walmart MoneyCard

For those who enjoy shopping at Walmart, the Walmart MoneyCard can be a fantastic option for a prepaid debit card. It’s a wise decision as you can reload enough money each month to avoid a monthly fee and receive some cash back through cash-back alternatives.

Although there is an annual cap on the amount you may earn, the Walmart MoneyCard is unique among reloadable cards in that it offers rewards. You may be able to acquire the annual rewards to make up for not being able to get the monthly charge eliminated.

Pros:

- Earn 3% cash back at Walmart.com, 2% back at Walmart fuel stations, and 1% back at Walmart stores

- Earn 2% annual interest on a linked savings account

- No monthly fee if you load $500 or more each month

- Free cash reloads via the Walmart MoneyCard App, direct deposit, mobile check deposit, and bank transfer

- Overdraft protection up to $200 with opt-in and eligible direct deposit

Cons:

- Cashback is capped at $75 per year

- The standard monthly fee is $5.94 if you don’t load $500 or more each month

- All ATM withdrawals will incur a $2.50 fee

American Express Serve Cash Back

You can earn a limitless 1% cash back reward on all of your transactions with the American Express Serve Cash Back. Because of its unlimited cash-back potential, this prepaid debit card stands out from the others.

Additionally, the card offers fee-free ATM access, letting you keep more of your money. Although receiving an endless 1% cash back may not be as good as with certain credit cards, this prepaid debit card sets a high bar.

Note that there is a $7.95 monthly fee associated with this card; however, this can be waived if you use the card for at least $795 in monthly purchases.

Pros:

- Earns unlimited 1% cash back on all purchases

- Access to over 30,000 fee-free ATMs

- Eligible purchases receive purchase protection*

Cons:

- Monthly fee of $7.95 (except in New York, Texas, or Vermont)

- Cash reloads may cost up to $3.95

- Mobile check deposits take 10 days unless a fee is paid

FamZoo Prepaid Debit Card

Because FamZoo focuses on parents, kids, and financial education, we chose it as the best card for tweens and adolescents. In addition to having sub-accounts, the FamZoo Prepaid Debit Card is unique in that it offers an extensive feature set that assists parents in teaching their kids about money management.

To encourage frugal spending and saving, parents can set up automated transfers, control card usage, and get four free prepaid cards.

Pros:

- You can request up to four prepaid cards for free and establish automatic recurring transfers (extra cards cost $3 each).

- Parents can lock or unlock cards, incentivize saving with interest from the parent’s account, and link transfers to allowances, chores, or a non-monetary rewards system.

- Access to fee-free ATMs.

Cons:

- A $5.99 monthly fee is applicable, but it can be reduced with advance payment.

- There is a $4.95 fee for loading cash onto the

FAQs

Q: What Is the Best Prepaid Debit Card?

The finest prepaid debit card depends on personal tastes and requirements, but two well-liked choices are the Chase Liquid card and the Bluebird by American Express.

Q: What Are the Downsides of Prepaid Debit Cards?

Prepaid debit cards have several drawbacks, such as lower rewards than standard credit cards and fees for purchases, ATM withdrawals, and monthly maintenance.

Q: What Is the Best Prepaid Card With No Fees?

The finest fee-free prepaid card is determined by a number of factors, including usage habits. The American Express Serve, Bluebird by American Express, and PayPal Prepaid Mastercard are a few options to think about.

Q: What’s the Best Prepaid Card for Direct Deposit?

The ideal prepaid card for direct deposit is determined by individual requirements and preferences. Options with direct deposit features include Netspend, Bluebird by American Express, and the Green Dot Prepaid Visa.